How inflation impacts on unit rates in property asset management

The highest inflation levels in 20 years make property asset management planning harder than ever. Here’s our guide on how to handle changes to unit rates – and how to plan for 2022 and beyond.

Both Australia and New Zealand are facing the highest rates of inflation in 20 years. Building materials are particularly hard hit – for example, timber prices in Australia have increased by 30%. Such price increases have a direct impact on property asset management: how will 20 to 30% cost increases affect your planning for 2022 and beyond?

The key to managing your property asset management planning in this environment is to pay careful attention to unit rates. It’s important to update unit rates annually during this period of inflation and instability – whereas perhaps it wasn’t so necessary in the relatively more stable years prior to 2019.

What are unit rates?

In property asset management planning, the unit rate is the cost per unit to replace an asset. And that includes the costs involved in removing the existing asset; purchasing and installing the new asset; and disposing the old asset. Hence, the unit rate may also be referred to as the unit replacement cost. Asset Managers use unit rates for a number of purposes, such as to:

- Calculate the value of an individual asset

- Estimate the cost of planned works

- Perform a valuation or revaluation of a group of assets.

With the unit rate forming the basis of such important calculations in property asset management, it’s essential to use a unit rate that’s as accurate as possible. However, that may be challenging right now with high levels of inflation. Here’s our guide on how to approach unit rates in this high inflation environment.

Review your unit rates

If it’s been a few years since you last reviewed your unit rates, then now’s the time to do it.

How does SPM Assets software help with setting unit rates?

SPM Assets software updates its standard reference library annually, including unit rates, but it still provides the flexibility for customers to customise these rates if necessary.

SPM Assets gathers data based on actual costs around New Zealand and Australia. However, it needs to be recognised there may be a lag between the data being available from our sources (Rawlinson’s Handbook in Australia, and QV Cost Builder in New Zealand – and also SPM Assets databases for all our markets, which contain data on over $150 billion in assets), and what is now happening in the market. These updates are made available to customers who have subscribed to the unit rate update service. We are also monitoring changes across our customers and including the movements within our annual reviews.

The rates may be varied by customers who have specific assets that are not catered for within the standard reference library listing. Asset group indexes cater for these items so they get a general rate of inflation applied that’s applicable to that asset group.

In many cases, it makes sense to use a combined approach of using the new rates in SPM Assets software and comparing them to actual rates experienced through recent contracts, e.g. repainting, air conditioner replacements, switchboard renewals, etc.

SPM Assets can also provide hands-on assistance with unit rate reviews. Some customers engage us annually, whereas others do this ad hoc, meaning there can be years between reviews. Now is definitely the time to review and update your rates.

What sorts of trends are there in unit rates in property asset management?

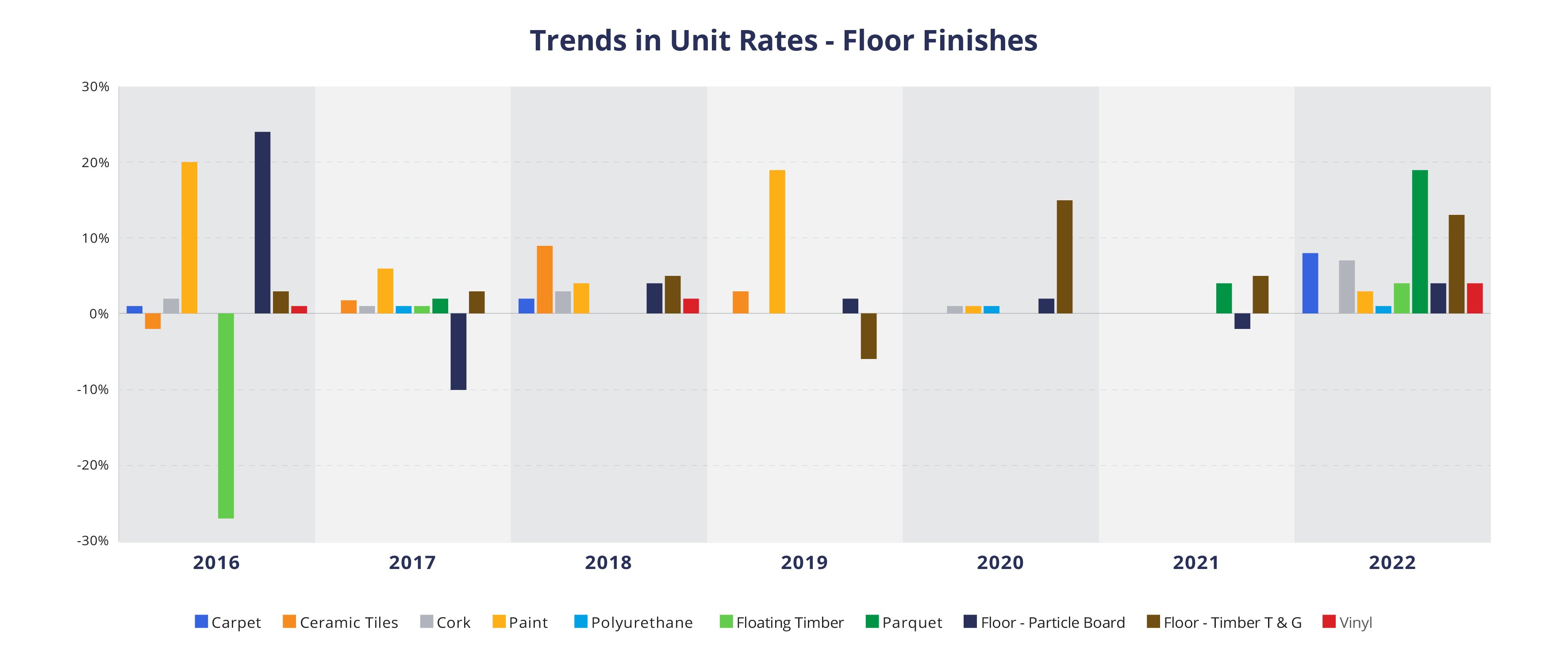

SPM Assets analyses unit rate trends year-on-year, and the changes from component to component can be erratic and surprising, as illustrated in the Australian examples below.

Floor finishes in Australia

- Particleboard jumped 25% in 2016, fell 10% the next year, and then stabilised.

- Floating timber dropped 27% in 2016, and stayed here despite a 4% rise this year.

- Paint finish increased by 20% in the same year, and then increased another 19% in 2019.

- Parquet has been very consistent but there was a sudden 19% increase this year.

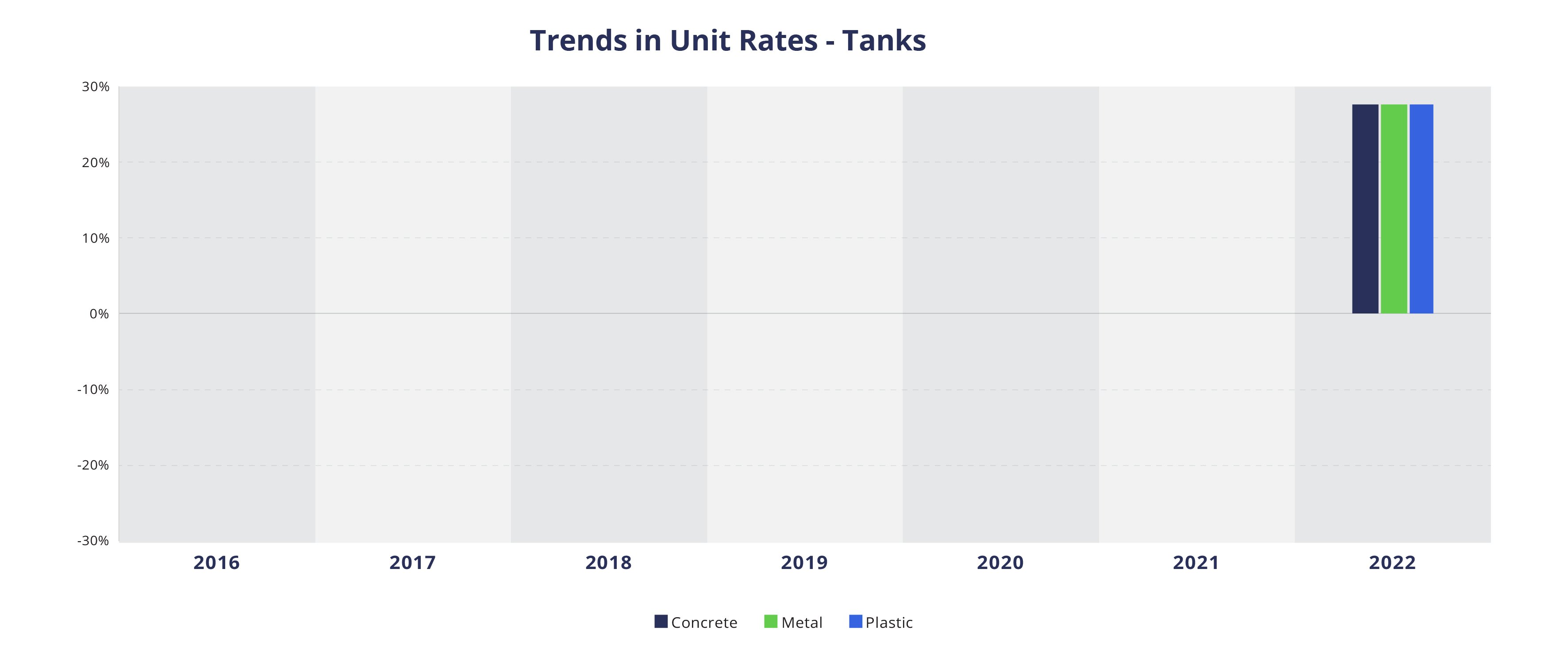

Tanks in Australia

- There have been no price movements since 2017, but there was a sudden 27% increase this year for all types.

Unit rate review for a local government in Australia

SPM Assets recently conducted a review of unit rates for a local government organisation in Australia. Although there were significant changes in the rates for condensing units (68% drop), evaporative coolers (59% drop), and fire hose reels (58% drop), nearly all other elements had price increases – some of them very significant. The biggest increases were for letterboxes (86% increase), office partitions (85% increase), and concrete slabs (70%) increase.

Because the changes in unit rates in property asset management can be significant and unexpected, it is prudent to review the rates annually so you’re not exposed to excessive risks and costs.

How to factor in this high inflation environment? Is it just a spike?

Once you’ve updated your unit rates in a way that works for your organisation, you now need to review your property asset management planning.

For the lifecycle and asset planning process, it’s suggested that you take a similar approach that’s used for valuations. That is, taking a three-year rolling average review – while being careful not to apply short-term market peaks.

However, if you’re using unit rates to determine project scopes and costings for the next year, it would make more sense to apply the more significant short-term fluctuations.

Depending on your industry, it may be prudent to add an additional rate of 10-20% to accommodate unexpected costs and fees.

Additionally, it may be a case of pushing out planned projects for a year or two until prices begin to stabilise again. Indeed, we’re already hearing reports of building costs reducing in some instances as supply chains free up.

As an asset manager, what do I need to do?

After you’ve reviewed your unit rates, it’s a matter of reviewing your Asset Management Plan and resulting works programme.

It’s important to be aware of fluctuations from a valuation perspective while recognising the impact on short-term project budgets. That’s why it’s necessary to proactively update your Asset Management Plan each year by:

- Checking your assumptions

- Checking your policies and standards and the planned works programme

- Checking your component-level unit rates

- Checking the budgets for your planned projects.

Remember: asset management planning is exactly that – planning – using the best information available at the time. This involves updating an Asset Management Plan annually to adjust. At the same time, it’s important to recognise that the actual short-term costs will be based on the immediate market conditions – and that all comes back to funding. An organisation may not be able to afford the longer-term, high-cost projects – but it needs to be able to sustain short-term project costs.

Next step

Contact us if you need help with your unit rate calculations or any other aspect of property asset management planning.

Subscribe to our Broadcast

Our monthly newsletter featuring asset management tips and insights, and the latest SPM Assets news.